LETTERS FROM THE GLOBAL PROVINCE

Catfish Caviar. For sure the wittiest designer around is one Mike Hicks who hangs his hat in Austin, Texas. We can remember that he once did a radio ad for a pizza joint that starred a young college lad and gal in a nudist colony who, having ordered-in a pizza pie, enjoyed a flurry of dripping mishaps. We don’t know whether the colony in question was located in the precincts of Austin, but most anything can happen near the Texas Capitol. After all, this is the state where Governor Rick Perry, who looked askance at all of President Barrack Obama’s bailout money and who actually talks about seceding from the Union, is going to blow $11 million of it to restore the Governor’s Mansion.

The last time business went into the ditch, Mike concocted

some catfish caviar which he packaged most handsomely for us, as you can see in

the accompanying illustration. You can also inspect this mythical product in Scenes from the Global Province. If he actually starts selling the stuff

in years to come, we will buy it for our dog, as we are certain it will be

cheaper than the overpriced beads of gosh knows what sold by the Pet Stupid

chain we are feeding her today. Even

as we all sweat out the current financial implosion in which Bernard Madoff’s stunned victims are straggling

through the streets of Palm Beach, we are urging those who still have a

farthing in their pockets to rally their comrades with the cheer, “Let us eat

caviar.”

most handsomely for us, as you can see in

the accompanying illustration. You can also inspect this mythical product in Scenes from the Global Province. If he actually starts selling the stuff

in years to come, we will buy it for our dog, as we are certain it will be

cheaper than the overpriced beads of gosh knows what sold by the Pet Stupid

chain we are feeding her today. Even

as we all sweat out the current financial implosion in which Bernard Madoff’s stunned victims are straggling

through the streets of Palm Beach, we are urging those who still have a

farthing in their pockets to rally their comrades with the cheer, “Let us eat

caviar.”

Why Bother? We’ve had several chortles lately with Texans all throughout the state who have battened down the hatches on their businesses and are simply waiting for better days. The oil titans know that the price of oil will come back, and its recent spike upwards is cheering some of the drillers, but dismaying the working poor, who are being eaten alive by $2.73 gasoline.

Dallas businessman Win Padgett wonders sometimes why he keeps the doors open at a few of his enterprises. He writes “By the way, have you seen the testimony shown below??? Makes me wonder why I’m concentrating on saving our beleaguered small businesses from the ravages of the recession rather than worrying about the ‘bigger picture’ taking place in Washington!!!”

The testimony to which he refers comes from the Inspector General of the Federal Reserve. The Fed has splashed around billions and trillions, but it would appear that neither she nor anyone at the Fed really knows where it all went and whether it was well spent. Padgett and others ask whether it make sense for them to save a few nickels and try to keep things going when the cows are out of the barn and all the real money is going into some government trough. In a society of surfeit that is riddled with excess, does it do much good to turn off the lights, re-use paper bags, or furlough a few employees? In fact, living high on the hog is so ingrained in America, it’s become hard to take up the simple life, to partake of prudence, to use sparingly what is offered us.

Big Government and Big Business. For sure, all the big organizations in our society are hugely overspending—governments, big business, universities, the whole of the medical industry, etc. As we have made clear elsewhere, health expenditures now account for north of 16% of GNP, and this reservoir of money has not bought us very good health. It seems pretty clear that one-third of all medical expenditures are either useless or harmful. An immensely conscientious Boston surgeon named Atul Gawande, who has puzzled over how to render better care at lower cost, well understands the snarls and tangles of the medical community, as he made clear in a recent article in The New Yorker. All sorts of people have itsy bitsy ideas on how to lower costs and improve quality, but none of their schemes have really worked. In the end, Gawande counsels us to look around the States for districts that render more for less. We’re afraid he’s wrong: we should be looking instead to other countries, like Finland, that do hugely better for less. We are so profligate in America that we have an acute need to look abroad to see how to do things frugally in health care, in business, in government, in defense.

For this reason, a very worthwhile article from the Rand Institute brings smiles to our face. Rand and others are fiddlin’, but all of us are burning. It has a number of prescriptions for “How Government Can Get More Bang for its Buck,” but, first and foremost, it lectures us to get outside contractors under control. There’s been a temptation to subcontract everything out to private firms over the last 25 years, and turn our backs on the Civil Service. But that’s apparently hugely expensive:

“In 1991,

GAO compared the costs of 12 contractors with the costs of government employees

working for the U.S. Department of Energy. On average, 11 of the 12 contractors

were 25 percent more costly than their federal counterparts. In 2007, the U.S.

House Select Committee on Intelligence found that, on average, an intelligence

community contractor cost almost twice as much as a government

employee. In 2008, the U.S. Office of the Director of National Intelligence

concluded that the full salary and benefits for government employees averaged

$125,000, whereas the direct labor cost per contractor, excluding overhead,

averaged $207,000.”

In fact, over the last 40 years, due to mismanagement of our economy and horrendous governance, manufacturing has stumbled and we have had huge and unproductive growth in services inside and outside government. We and the Germans are vastly overbanked, for instance, and there will have to be massive consolidation in that industry. We are blessed with hordes of overpaid professionals—investment bankers and lawyers and accountants and on and on—all coming from fields that are vastly inefficient and, arguably, have sapped our economy. They account for what we call friction or transaction costs, something one strives to minimize. It’s hard for Mr. Padgett to help rebuild our new economy when we are being bled by service costs all around us, of which government is only a part. The nickels Mr. Padgett saves are siphoned off to provide welfare for the bureaucracies in government and at all our other big institutions, as we rob useful Peter to pay useless Paul.

Soap Opera Savings. There’s a lot of comedy to be had from following the antics of confirmed affluents who have sort of decided to tighten their belts. The profligate simply don’t do cheap very well. We recommend to your attention, for instance, Ms. Alexandra Penney, whose savings were grabbed by Mr. Madoff. She now makes do with a patched up Mercedes but still manages to cadge meals at the Four Seasons in New York. A modern version of Madame Bovary who is out of kilter with modern American society, her very well written Bag Lady Papers serial tells us about her picaresque woes in The Daily Beast. Ms. Penney is down to her last sou. Her fears and paranoia could make decent TV:

“Bag lady

fears and visions haunt me at my usual 4 o’clock waking hour, when the world is

a monotone gray and bleak, and I am stone-cold terrified of what will become of

me. I compulsively add up every dollar I could make from selling everything I

have. But occasionally a new fantasy surges through my beleaguered brain, and

it helps to declaw the demons.”

As amusing is the tale of the Peacocks. Amanda and Richard made their real estate fortune in Florida, the land of spectacular busts since time immemorial. Mr. Peacock claims, “It’s time to simplify.” Even with an auction, they’ve had a ticklish time getting rid of some of their baubles:

“When the six cars came on the block, however, the sale

stalled. Only one—a cloned 1970 Plymouth Hemi Cuda convertible—reached

Mr. Peacock’s asking price. The Peacocks didn’t accept the bids on the others,

including the Ferrari. An Italian speedboat and a pair of jet skis also failed

to sell.

“Bids on the house ground to a halt at $5.5 million. The

Peacocks decided they couldn’t let it go for that. Since they didn’t want to

live in an empty mansion, they pulled the other items, including the parrots,

off the block.

“In all, 500 items sold for about $300,000. About

$200,000 went to pay the auctioneer and other expenses. Both houses are still

on the market.”

Daniel Boulud, a fine restauranteur

who feeds New York’s highflyers, is now working on a new eatery that will cater

to the fallen famous, such as Ms. Penney and the Peacocks. His DBGB,

its name aping a punk rock club just a block away, is on the Bowery, the

traditional home of the down and out-of-luck. “‘It’s indulgence on a

dime instead of indulgence on a dollar,’ he said, summing up DBGB.” We’re happy

to see he’s still bringing his same perfectionist spirit to this enterprise for

the newly thrifty. We expect prices to decline from absolutely absurd to the

merely ridiculous.

The Long Dismal History of Cost Cutting. People with short memories forget that we’ve been on a

drunken cost-cutting binge since the 1960s, perhaps as one outcome of the

Vietnam War when America began to lose its place in the sun. It was then that we began to suffer geopolitically,

felt our suzerainty in world affairs slip away, and saw our global economic

dominance erode a little more each year. Desperately we began to shave costs in all sorts of half-baked ways.

Life for America has fallen out of bed. As a New York wag says, “The American dream has been interrupted by the

Japanese clock radio.”

In fact, the big consulting firms, which don’t really have much to offer

companies when it comes to growing revenues, all took up cost cutting as a mantra, suggesting

it would cure whatever ails you. The most interesting was the Boston Consulting Group, which climbed on the experience

curve, more or less saying that as you made more and more of a certain

product, you got smarter, and your costs of making it declined. The charge was

led by CEO Bruce

Henderson, a onetime Bible salesman, who told the world BCG could do wonders with “the experience curve”

and “cash cows.” He was a devil of

a nice fellow, worth talking to for hours, who was eventually shunted

aside—sadly—by the apparatchiks in his own firm. That’s what

happens when you ride the cost curve.

Cost cutting mostly doesn’t work because you cut out the wrong things and

you don’t get out enough costs to buy ongoing market share. It is pretty much

like trying to lose weight—you take it off in all the wrong places and it

comes back in a flash. After a few years of trying this diet and that, you

realize that all the dieting just isn’t working. In April 1990, even that cheerleader

for American business—Fortune—shouted,

“So far, downsizing

just hasn't delivered. Companies are sometimes leaner but rarely meaner.

Lessons for the Nineties: Eliminate work, not necessarily workers.” For a short while, we get religion

about holding down expenses, but we don’t really have the stomach for it.

We

have learned that cost cutting is never done surgically or selectively, but

rather dumbly, across the board, by people with little feel for quality or

competitive strength. Vital organs

have been sacrificed in order to save pennies: products, services, and processes have all been cheapened,

and breakdowns abound. An

expatriate moving back to the United States from, say, Singapore will shrug in

pain, “I have moved from a first world country to a third world nation.” The price of ham-fisted cost cutting is

very expensive, indeed.

Always Low Prices, Always. “Always Low Prices, Always” is Wal-Mart’s

traditional slogan, though it has now officially been replaced. Only the words

have changed, since cost alone is still the driving force throughout the

company. It is the world’s biggest company, but it has most changed life in these

United States, where we buy most of its stuff, and China, where boatloads of

the stuff comes from. We’ve

observed over the years that quality never survives at Wal-Mart: we can name a whole list of products it

no longer stocks because they were too good for its store buyers down in

Arkansas. Even if a supplier is

offering a rock bottom wholesale price to Wal-Mart, it still asks for more cuts

in subsequent years. It slices the

price and dices its suppliers.

This

low-cost mentality has had a numbing effect on the economy in more ways than

one can imagine. In particular, it

has gotten the whole nation, not just Wal-Mart shoppers, used to the idea of

eschewing quality for cost. It has

made it hard for quality producers to survive, because Gresham’s Law applies

to more than currency: over time

bad quality will drive out high quality in all our marketplaces if we permit

it. The implications are

disastrous for the United States: no matter what we do, we are a high-cost nation. The only strategic option for a high-cost

nation is to produce high-quality, highly innovative, usefully differentiated

products. If schlock dominates our marketplace, it does not bode well for our

economy.

In

a better era, Sears

Roebuck, a huge precursor to Wal-Mart, offered a whole range of products that

one could trust at very good prices. As such, it did not lower our expectations

for ourselves, for our companies, for what we craft and do. It knew that “we

cannot afford to lose a customer.” It’s possible to do better at Wal-Mart, but first the fellows

in Bentonville will have to upgrade their values and their vision. Combining

frugality with quality is a different mindset from crude price cutting.

Radical Departures. Yet

all this evidence of cost cutting gone astray does not mean we cannot save big

bucks, have our cake, and eat it, too. Chaps who cut the weeds, trim out costs, and consolidate factories don’t

really change the way we do things. They just do cheaper, bad knockoffs of the past. To get cheaper and better while

creating a little joy, we need to go way outside the present system. The goal

in cost cutting should be to create something entirely new. This is virtue

borne of necessity.

For

instance, we have a gigantically bad phone system. We used to have one fairly benevolent monopoly called

AT&T that was well regulated. Now, instead, we have shoddy regulation and 6 or so creaky, badly run

monopolies with bad service, poor technology, humongous overpricing, and

worse. It will be hard to put a

patch on that mess.

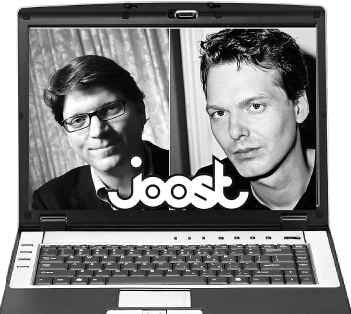

But

along came Skype (and a few similar systems) that run over the Internet. Skype is the invention of some northern Europeans, Niklas

Zennstrom and Janus Friis, that permits one to call other users for free and to pay a very small tariff to

call the phones of those people who have not put the Skype software onto their

computers. In other words, it

drives businesses and individuals to simply go round the big, unwieldy, shoddy

telephone companies. That’s how

costs really come down. And it’s

how the future happens.

But

along came Skype (and a few similar systems) that run over the Internet. Skype is the invention of some northern Europeans, Niklas

Zennstrom and Janus Friis, that permits one to call other users for free and to pay a very small tariff to

call the phones of those people who have not put the Skype software onto their

computers. In other words, it

drives businesses and individuals to simply go round the big, unwieldy, shoddy

telephone companies. That’s how

costs really come down. And it’s

how the future happens.

We

will have to do something as eccentric to get healthcare costs under

control. Most of the schemes to

improve healthcare have been originated by people who are part of and benefit from

the present healthcare system: they’re not about to really tear it apart. In America, we will probably get costs down by preventive

self-care, which means regular exercise, cautious dieting, no smoking, and

periodic colonoscopies. Better health and lower costs will come from not having

to use the medical system as we know it.

What We Need and What We Don’t Need. In times past, various pundits

have demonstrated how the advertising industry and industry hucksters have

generated demand for products and services we really don’t need. Vance Packard talked of some of the

tricks used to create false hungers in The Hidden Persuaders. Sure enough we are churning out awesome

amounts of stuff we have no use for, occasionally creating bulging warehouses

no matter how much the salesmen peddle.

Meanwhile,

we cannot get what we really want. It’s hard to get a decent cell phone (though Samsung has drummed up a

simple phone with big buttons for oldsters), and we are forced to buy crummy

devices that break easily and have poor reception. Sold by the cell phone monopolies, they’re loaded with

cameras, and email, and other unnecessary functions that make the devices yet

more unstable. In fact, certain of the overseas cell phone makers hate to do

business with our telephone companies since they know they will have to produce

bad phones informed consumers don’t want. The task at hand for us is to get rid

of what we don’t need, so that we can get more of what we do.

P.S. Marie

Antoinette, during a bread crisis, is supposed to have said, “Let Them Eat Cake.” Actually she was offering brioche. When

times are tight, we are inclined to offer crumbs to the unlucky.

P.P.S. Here and there these days,

we keep encountering an old adage-“Never Economize on Luxury.” Wherever we turn, we are amazed at the

luxuries still considered vital by those whose lives have been addicted to

conspicuous consumption, even though their net worths have declined by 30% or

more.

P.P.P.S. Today’s

newspaper brings us the heartwarming news that Le Rendez-Vous French Bakery Cafe and Belgian Chocolate in Colebrook, New Hampshire, has been

given a last-minute reprieve from the hangman’s noose. One of the partners, Verlaine Daeron,

was to lose her American E-2 visa, essentially because her business here had

not become big-time enough for the factotums in the State Department. Senator

Shaheen and others have intervened. Theirs is exactly the kind of business

America needs to revitalize our economy and society—a boutique that is

frugal, one of a kind, and high quality. It is the kind of business many

emigrants have a feel for. Vivek Wadhwa, an entrepreneur

who now devotes himself to immigration policy, understands that new Americans,

the bright types who come in from Europe and Asia, will build our future

economy. People abroad have some familiarity with the kind of business model

the United States needs now. The mass production era is winding down, and we

need smart, custom providers.

P.P.P.P.S. Irving Berlin’s Puttin’ on the Ritz descended on America in 1929, a time of very mixed fortunes, just as in the

present day. It referred both to

the affluent, and even the poor who dressed up to look affluent, in a time when

the country was dragging its heels.:

If you're blue and you don't know where to go to

Why

don't you go where fashion sits?

Puttin' on the Ritz

Different types who wear a day, coat pants with stripes and cutaway

Coat perfect fits

Puttin' on the Ritz”

Home - About This Site - Contact Us

Copyright 2009 GlobalProvince.com